A New Incentive For First Time Home Buyers

What is First-Time Home Buyer Incentive and is it the best option for me?

Buying your first home is one of the biggest investments you’ll make in your life and to say the price tag that comes with it is a tad horrifying is an understatement. Well everyone, the Canadian people have spoken and the Canadian Government has responded… with the introduction of the First-Time Home Buyer Incentive program! What a time to be alive! If this is the first time you’ve heard of the program and you’re looking to purchase your own home for the first time, listen up.

The First-Time Home Buyer Incentive focuses on helping middle-class Canadians purchase their first home. The Government of Canada wants to take part in the investment of your new home, providing five per cent towards your purchase. As a result, decreasing your mortgage amount, your monthly payments AND the stress on your wallet (Yay! More Skip The Dishes.) However, every great thing comes with conditions (sorry to be a downer.) The Canadian Government acts as a silent investor, sharing the losses and gains of the constantly changing market. The article “Determine if the First-Time Home Buyer Incentive makes sense for you” published in the Edmonton Journal states that the Government “holds a second mortgage on your home, which will require payout when you sell, or in 25 years, whichever comes first.” Now we’ll hit you with some good news again. The article written by Heather Faulkner goes on to explain that if you choose to purchase a new home, “that five per cent can be increased to a whopping 10 per cent.” She goes on to write that “it doesn’t sound like a lot, but when you think the average home is still more than $400,000, the dollars add up!”

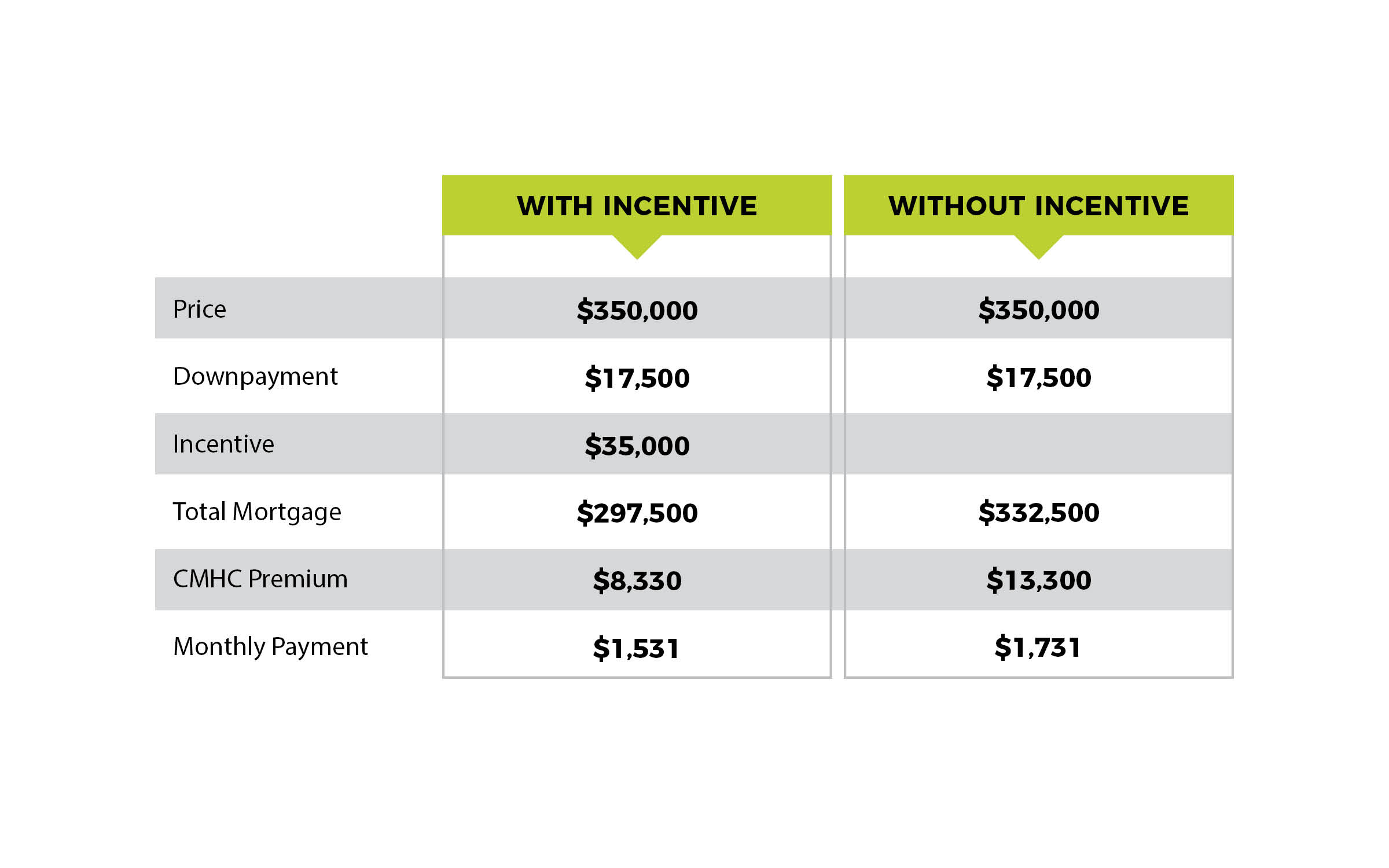

The Edmonton Journal put together a perfect example of how the First-Time Home Buyers Incentive works.

“Jane Doe is a first-time home buyer. She meets the qualification requirements for income and down payment. She makes less than $120,000 a year, has been saving money for years and has a nest egg of $17,500, which is a five per cent down payment ready to go on a $350,000 home. She purchases a new build home and applies for the incentive of 10 per cent.”

According to the example, Jane Doe saves $200 in monthly savings and a reduction on her CHMC mortgage insurance premiums of approximately $5,000.

The qualifications for the program are pretty straight forward. Whether you’re divorced and a first time home buyer or even if you haven’t owned your own home is four years, you can still qualify. Some of the qualifications are:

-Mortgage must be insured and be less than 20 per cent down payment from traditional sources

-Can be one to four residential units

-At least one person on the title who has never owned a home

Buying your first home is a HUGE step in life, but the price tag shouldn’t stop you from doing so. If you’d like more information on the First Time Home Buyer’s Incentive, check out our podcast https://sarasotarealty.ca/podcast/episode-2-8-listed-season-2-a-new-incentive-for-first-time-home-buyers/ or head to https://www.placetocallhome.ca/fthbi/first-time-homebuyer-incentive

Sources: